Confronting the Legacy Cost Challenge

October 31, 2010

When GM declared bankruptcy, pundits remarked that it had become a pension benefit company that made cars on the side. Unfortunately, very similar dynamics are at work in state and local governments around the country. The lingering effects of the 2008 investment losses, coupled with lower tax revenues and changing demographics (like people living longer than expected) are causing pension and retiree healthcare costs to consume an ever-increasing slice of city budgets.

The Detroit Free Press recently ran an article on the subject of Michigan municipal pensions.

It is important for Muskegon City taxpayers to know that: 1) Muskegon is not immune to these pressures and, 2) specific steps have been taken to prevent pension and retiree healthcare costs from overwhelming the City’s budget.

Pensions

Following are measures the City has taken in recent years to ensure that its pension obligations are kept manageable:

- Move to MERS – Administration of the City’s pension programs was moved to the statewide Municipal Employees Retirement System (MERS) starting in 2005. This move has saved the City money while at the same time improving the level of services provided to employees and retirees of the City.

- Defined Contribution Retirement for New Employees – Defined benefit (DB) pensions, which provide a guaranteed pension for life, have been the staple in government for many years. However, the risk and liabilities for financing DB pensions rest solely with the City. Particularly with the recent financial collapse, many experts consider DB pension plans to be unsustainable for the future. The City has closed its existing DB plans to new members and, since 2006, new employees are members of a defined contribution (DC) retirement plan. DC plans are similar to 401(k) plans that are the predominant type of retirement program for private firms.

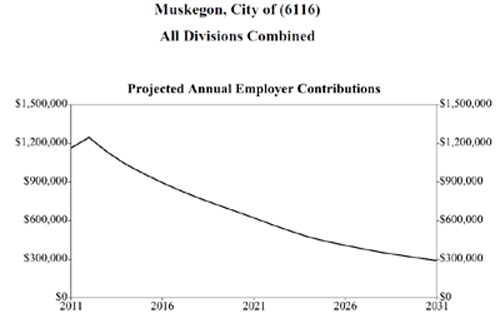

- Full Funding of Pension Costs – Each year an actuarial valuation of the City’s DB pensions is performed. The City has always followed a policy fully funding the actuary’s cost recommendation for keeping the pension funds in sound financial condition. The charts are based on data from the system-wide MERS 12/31/09 actuarial valuation. They illustrate that City’s pension funding policy has helped keep these programs financially sound.

Summary: The City has well funded defined benefit pensions yet has made the decision to exit from the defined benefit pension business. Defined benefit retirement systems entail long-term risks and liabilities that the City does not want to have encumber its future. New employees are enrolled in a defined contribution plan that doesn’t entail long term liabilities for taxpayers. However, the process will take several decades to complete. The City has kept its pension programs well-funded and must continue to do so in the future until all pension obligations are met.

Phasing out of the defined benefit pension business will take many years. This graph from the 12/31/09 actuarial valuation shows how the City’s annually required DB pension contributions are projected to decline over time.

Retiree Health Care Benefits

In addition to retirement pensions, many states and cities (including Muskegon) have made promises to provide health care benefits to retirees. Typically these promises were made at a time when healthcare costs were moderate and extending coverage to retirees did not appear too costly. Today, however, retiree healthcare has become a major liability and budget burden. Like escalating pension costs, retiree healthcare costs threaten to crowd out expenditures for police, fire and other essential public services.

Most governments do not set aside funds to pay for future retiree healthcare liabilities as they do for pensions. Instead, they fund these costs on a “pay-as-you-go” basis out of the annual operating budget. Pay-as-you-go funding means that investment earnings do not accrue to help pay future costs. Instead, actual benefit payments consume an ever-growing portion of the budget as the number of retirees grows and healthcare costs escalate.

The City of Muskegon recognizes this issue and has taken specific steps to ensure that its retiree health care obligation remain manageable:

- Actuarial Funding – Muskegon pre-funds its retiree healthcare costs, in the same manner it funds pension costs. An actuarial study is regularly done to determine the annual contribution required to pay for current and future retiree health care benefits. The most recent actuarial valuation of the City’s retiree healthcare program was as of 12/31/09 and showed the following status:

| Parameter | Category |

|---|---|

| Chlorine | Process control, microbiological |

| Turbidity | Process control |

| pH | Process control |

| Temperature | Process control |

| Color | Process control |

| UV254 (organic matter) | Process control |

| Fluoride | Process control, chemical |

| Alkalinity (as CaCO3) | Process control |

| Hardness (as CaCO3) | Process control |

| Calcium hardness | Process control |

| Magnesium hardness | Process control |

| Chloride | Process control |

| E. coli | Microbiological |

| Total Coliform | Microbiological |

| Heterotrophic plate count | Microbiological |

| Odor | Process control |

| Total Organic Carbon | Disinfection by products (DBP), total organic carbon |

| Specific ultaviolet absorbance (SUVA) | Disinfection by products (DBP), total organic carbon |

| Dissolved organic carbon | Disinfection by products (DBP), total organic carbon |

| Bromoacetic Acid | Disinfection by products (DBP), haloacetic acids |

| Chloroacetic Acid | Disinfection by products (DBP), haloacetic acids |

| Dibromoacetic Acid | Disinfection by products (DBP), haloacetic acids |

| Dichloroacetic Acid | Disinfection by products (DBP), haloacetic acids |

| Trichloroacetic Acid | Disinfection by products (DBP), haloacetic acids |

| Chloroform | Disinfection by products (DBP), trihalomethanes |

| Bromodichloromethane | Disinfection by products (DBP), trihalomethanes |

| Dibromochloromethane | Disinfection by products (DBP), trihalomethanes |

| Bromoform | Disinfection by products (DBP), trihalomethanes |

| Iron | Chemical |

| Sodium | Chemical |

| Nitrate | Chemical |

| Nitrite | Chemical |

| Sulfate | Chemical |

| Chloromethane | Volatile organic compounds (VOC) |

| Vinyl chloride | Volatile organic compounds (VOC) |

| Bromomethane | Volatile organic compounds (VOC) |

| Chloroethane | Volatile organic compounds (VOC) |

| Trichlorofluoromethane | Volatile organic compounds (VOC) |

| 1,1-Dichloroethene | Volatile organic compounds (VOC) |

| Methyl-tert-butyl ether | Volatile organic compounds (VOC) |

| Methylene chloride | Volatile organic compounds (VOC) |

| trans-1,2-Dichloroethene | Volatile organic compounds (VOC) |

| 1,1-Dichloroethane | Volatile organic compounds (VOC) |

| 2-Butanone | Volatile organic compounds (VOC) |

| cis-1,2-Dichloroethene | Volatile organic compounds (VOC) |

| 2,2-Dichloropropane | Volatile organic compounds (VOC) |

| Bromochloromethane | Volatile organic compounds (VOC) |

| Tetrahydrofuran | Volatile organic compounds (VOC) |

| Chloroform | Volatile organic compounds (VOC) |

| 1,1,1-Trichloroethane | Volatile organic compounds (VOC) |

| 1,1-Dichloropropene | Volatile organic compounds (VOC) |

| Carbon tetrachloride | Volatile organic compounds (VOC) |

| Benzene | Volatile organic compounds (VOC) |

| 1,2-Dichloroethane | Volatile organic compounds (VOC) |

| Trichloroethene | Volatile organic compounds (VOC) |

| 1,2-Dichloropropane | Volatile organic compounds (VOC) |

| Dibromomethane | Volatile organic compounds (VOC) |

| Bromodichloromethane | Volatile organic compounds (VOC) |

| cis-1,3-Dichloropropene | Volatile organic compounds (VOC) |

| Toluene | Volatile organic compounds (VOC) |

| trans-1,3-Dichloropropene | Volatile organic compounds (VOC) |

| 1,1,2-Trichloroethane | Volatile organic compounds (VOC) |

| 1,3-Dichloropropane | Volatile organic compounds (VOC) |

| Tetrachloroethene | Volatile organic compounds (VOC) |

| Dibromochloromethane | Volatile organic compounds (VOC) |

| 1,2-Dibromoethane (EDB) | Volatile organic compounds (VOC) |

| Chlorobenzene | Volatile organic compounds (VOC) |

| 1,1,1,2-Tetrachloroethane | Volatile organic compounds (VOC) |

| Ethylbenzene | Volatile organic compounds (VOC) |

| m,p-Xylene | Volatile organic compounds (VOC) |

| o-Xylene | Volatile organic compounds (VOC) |

| Xylenes, total | Volatile organic compounds (VOC) |

| Styrene | Volatile organic compounds (VOC) |

| Bromoform | Volatile organic compounds (VOC) |

| Isopropylbenzene | Volatile organic compounds (VOC) |

| 1,1,2,2-Tetrachloroethane | Volatile organic compounds (VOC) |

| 1,2,3-Trichloropropane | Volatile organic compounds (VOC) |

| Bromobenzene | Volatile organic compounds (VOC) |

| n-Propylbenzene | Volatile organic compounds (VOC) |

| 2-Chlorotoluene | Volatile organic compounds (VOC) |

| 1,3,5-Trimethylbenzene | Volatile organic compounds (VOC) |

| 4-Chlorotoluene | Volatile organic compounds (VOC) |

| t-Butyl Benzene | Volatile organic compounds (VOC) |

| 1,2,4-Trimethylbenzene | Volatile organic compounds (VOC) |

| sec-Butylbenzene | Volatile organic compounds (VOC) |

| p-Isopropyltoluene | Volatile organic compounds (VOC) |

| 1,3-Dichlorobenzene | Volatile organic compounds (VOC) |

| 1,4-Dichlorobenzene | Volatile organic compounds (VOC) |

| 1,2,3-Trimethylbenzene | Volatile organic compounds (VOC) |

| 1,2-Dichlorobenzene | Volatile organic compounds (VOC) |

| 1,2-Dibromo-3-chloropropane | Volatile organic compounds (VOC) |

| Naphthalene | Volatile organic compounds (VOC) |

| Hexachloroethane | Volatile organic compounds (VOC) |

| 1,2,4-Trichlorobenzene | Volatile organic compounds (VOC) |

| Hexachlorobutadiene | Volatile organic compounds (VOC) |

| 1,2,3-Trichlorobenzene | Volatile organic compounds (VOC) |

| PFAS | Per-and polyfluoroalkyl substances (PFAS) |

| PFBS | Per-and polyfluoroalkyl substances (PFAS) |

| PFHxA | Per-and polyfluoroalkyl substances (PFAS) |

| HFPO-DA | Per-and polyfluoroalkyl substances (PFAS) |

| PFHxS | Per-and polyfluoroalkyl substances (PFAS) |

| PFHpA | Per-and polyfluoroalkyl substances (PFAS) |

| ADONA | Per-and polyfluoroalkyl substances (PFAS) |

| PFOA | Per-and polyfluoroalkyl substances (PFAS) |

| PFOS | Per-and polyfluoroalkyl substances (PFAS) |

| PFNA | Per-and polyfluoroalkyl substances (PFAS) |

| 9Cl-PF3ONS | Per-and polyfluoroalkyl substances (PFAS) |

| PFDA | Per-and polyfluoroalkyl substances (PFAS) |

| NMeFOSAA | Per-and polyfluoroalkyl substances (PFAS) |

| NEtFOSAA | Per-and polyfluoroalkyl substances (PFAS) |

| PFUnA | Per-and polyfluoroalkyl substances (PFAS) |

| 11Cl-PF3OUdS | Per-and polyfluoroalkyl substances (PFAS) |

| PFDoA | Per-and polyfluoroalkyl substances (PFAS) |

| PFTrDA | Per-and polyfluoroalkyl substances (PFAS) |

| PFTA | Per-and polyfluoroalkyl substances (PFAS) |

| Gross Alpha | Radiological |

| Radium 226 & 228 | Radiological |

| Lead | Lead & Copper, Metals |

| Copper | Lead & Copper |

| Cyanide | Chemical |

| Antimony | Metals |

| Arsenic | Metals |

| Barium | Metals |

| Beryllium | Metals |

| Cadmium | Metals |

| Chromium | Metals |

| Nickel | Metals |

| Selenium | Metals |

| Thallium | Metals |

| Mercury | Metals |

| Atrazine | Pesticides |

| Benzo(a)pyrene | Pesticides |

| Chlordane-Technical | Pesticides |

| di(2-ethylhexyl)adipate | Pesticides |

| di(2-ethylhexyl)phthalate | Pesticides |

| Endrin | Pesticides |

| Heptachlor | Pesticides |

| Heptachlor epoxide | Pesticides |

| Hexachlorobenzene | Pesticides |

| Hexachlorocyclopentadiene | Pesticides |

| Lindane (gamma-BHC) | Pesticides |

| Methoxychlor | Pesticides |

| PCB (aroclors) | Pesticides |

| Simazine | Pesticides |

| Toxaphene | Pesticides |

| Aldicarb | Carbamates |

| Aldicarb sulfone | Carbamates |

| Aldicarb sulfoxide | Carbamates |

| Carbaryl | Carbamates |

| Carbofuran | Carbamates |

| Methiocarb | Carbamates |

| Methomyl | Carbamates |

| Oxamyl | Carbamates |

| Propoxur | Carbamates |

| 2,4-D | Herbicides |

| Acifluorfen | Herbicides |

| Bentazon | Herbicides |

| Dicamba | Herbicides |

| Dinoseb | Herbicides |

| Pentachlorophenol | Herbicides |

| Picloram | Herbicides |

| Total DCPA degradates, mono- and di-acid | Herbicides |

| 2,4,5-T | Herbicides |

| 2,4,5,-TP (silvex) | Herbicides |

| MC-HTYR | Algal toxins |

| MC-LA | Algal toxins |

| MC-LF | Algal toxins |

| MC-LR | Algal toxins |

| MC-LR Asp3 | Algal toxins |

| MC-LR Surrogate | Algal toxins |

| MC-LW | Algal toxins |

| MC-LY | Algal toxins |

| MC-RR | Algal toxins |

| MC-WR | Algal toxins |

| MC-YR | Algal toxins |

| Nodularin | Algal toxins |

| Anatoxin-A | Algal toxins |

| Cylindrospermopsin | Algal toxins |

| Cryptosporidium | Microbiological |

| Giardia | Microbiological |

- Scaled-back Benefits – Recognizing the unsustainable high cost of providing healthcare benefits in retirement, the City and its employee groups have agreed to significantly reduce these benefits for future retirees. Most recently, police and fire employees have agreed that future retirees will no longer receive a prescription card benefit. Other changes have included higher co-pays, required use of generic prescriptions, and required use of prescription mail-order programs.

- Transitioning to Health Care Savings Accounts – The City has put into place tax-advantaged savings vehicles that enables employees to save for health care needs in retirement. Over time, the City intends to move away from guaranteeing medical benefits in retirement and, instead, provide tools and incentives to help employees save for this purpose. Some employee groups have already agreed to replace guaranteed retiree healthcare benefits for new hires.

Summary: Unlike most state and local governments, Muskegon has advance funded its retiree health care obligations for more than 20 years. Still, the City faces a large future liability (about $15 million) to fully meet its commitments. In addition to paying the full actuarially-determined cost each year, the City is actively pursuing reductions/eliminations of benefits for future retirees. This helps lower the outstanding liability.